41 present value formula coupon bond

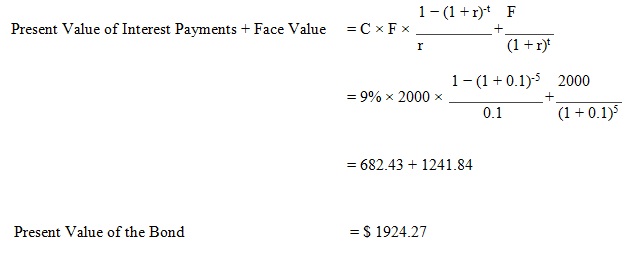

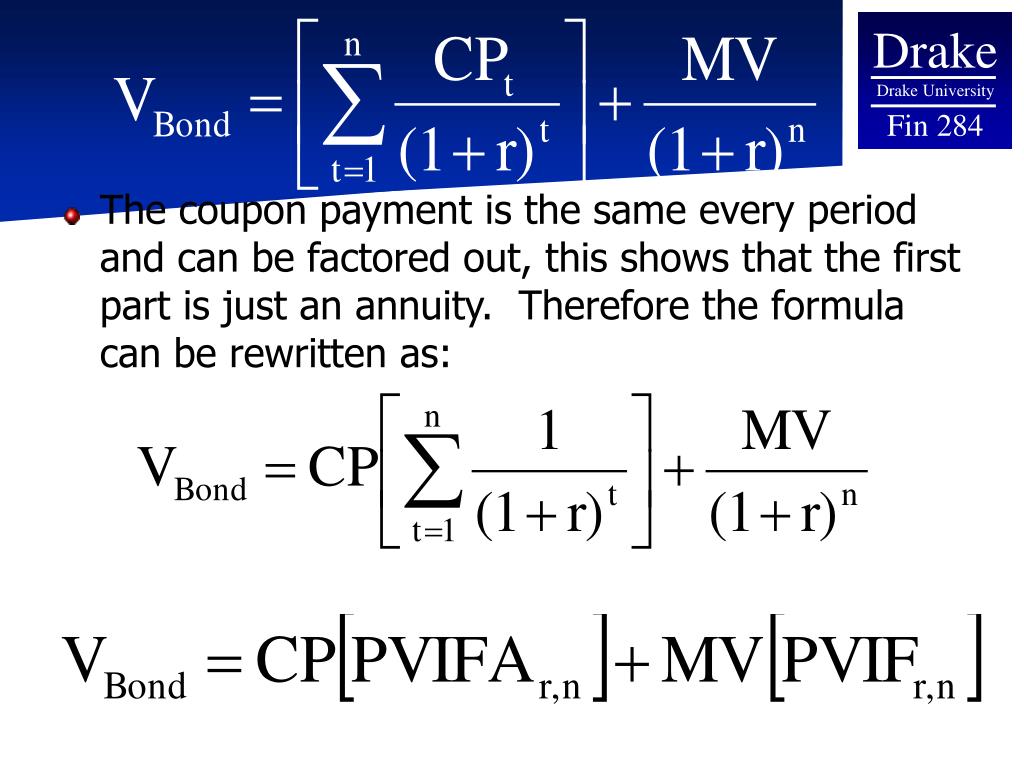

pediaa.com › how-to-calculate-present-value-of-a-bondHow to Calculate Present Value of a Bond - Pediaa.Com Sep 02, 2014 · Calculate present value of a bond: Step 1: Calculate Present Value of the Interest Payments. Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond F = Face value of the bond R = Market t = Number of time periods occurring until the maturity of the bond. Step 2: Calculate Present Value of the Face Value of the Bond How to Calculate PV of a Different Bond Type With Excel

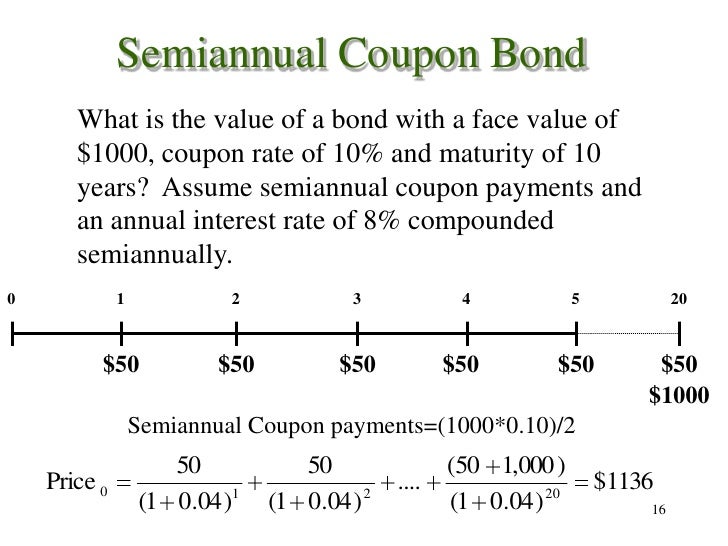

› coupon-bond-formulaCoupon Bond Formula | How to Calculate the Price of Coupon Bond? 6 steps1.Firstly, determine the par value of the bond issuance, and it is denoted by P.u003cbr/u003e2.Next, determine the periodic coupon payment based on the coupon rate of the bond based, the frequency of the coupon payment, and the par value of the bond. The coupon payment is denoted by C, and it is calculated as u003cstrongu003eC = Coupon rate * P / Frequency of coupon paymentu003c/strongu003eu003cbr/u003e3.Next, determine the total number of periods till maturity by multiplying the frequency of the coupon payments during a year and the number of years till maturity. The number of periods till maturity is denoted by n, and it is calculated as,u003cstrongu003e n = No. of years till maturity * Frequency of coupon paymentu003c/strongu003eu003cbr/u003e

Present value formula coupon bond

Post a Comment for "41 present value formula coupon bond"