38 coupon rate bond calculator

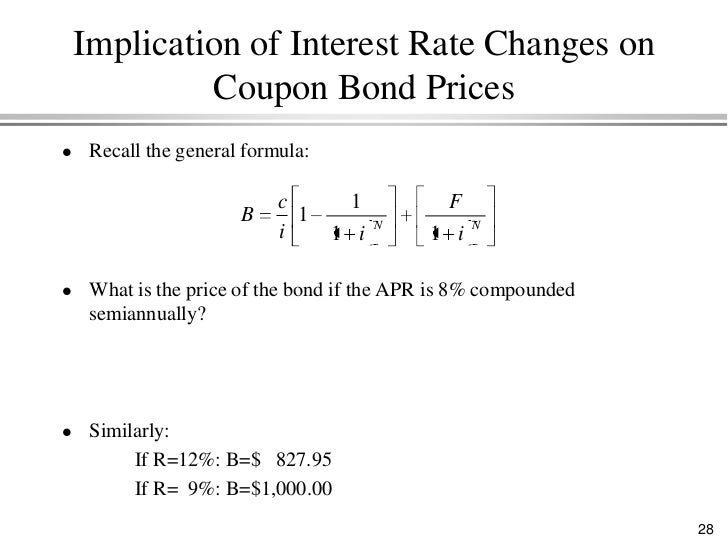

Bond Valuation: Formula, Steps & Examples - Study.com Bond Terms. Horse Rocket Software has issued a five-year bond with a face value of $1,000 and a 10% coupon rate. Interest is paid annually. Similar bonds in the market have a discount rate of 12%. Bond Dirty Price Calculator - CALCULATOR RUT - Blogger Dirty price is the present value of future coupon payments and maturity value of the bond determined using the following formula: Yield to maturity % face value $ coupon rate % payments per year. To calculate a bond's dirty price, simply add the quoted price and the accrued interest, which is another calculation altogether. Source ...

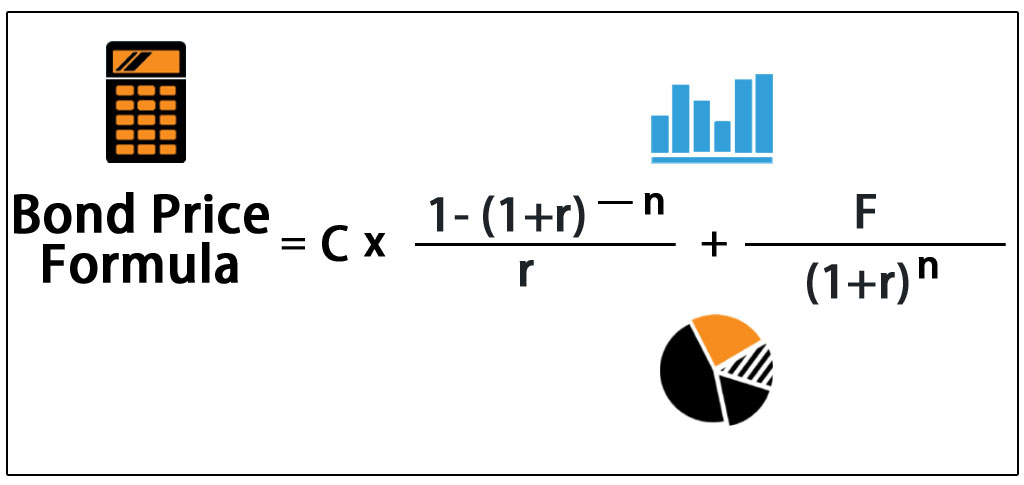

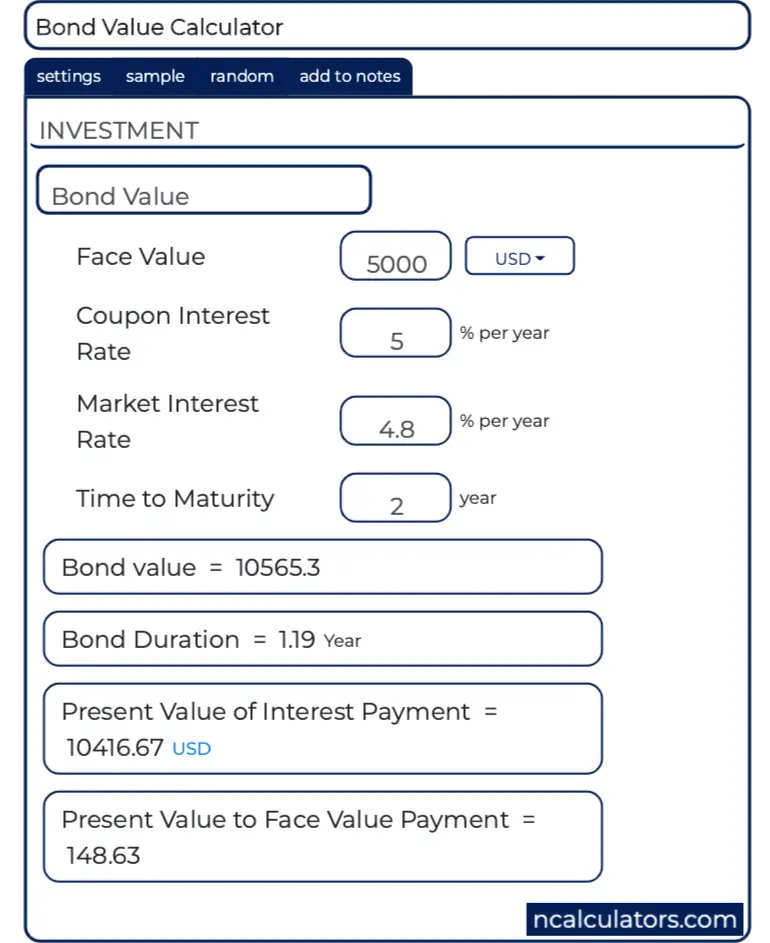

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50.

Coupon rate bond calculator

Zero Coupon Bond Calculator - Calculator Academy Zero Coupon Bond Formula. The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t. where ZCBV is the zero-coupon bond value. F is the face value of the bond. r is the yield/rate. t is the time to maturity. Calculating Tax Equivalent Yield on Municipal Bonds Here's how you calculate the TEY in a few steps: Find the reciprocal of your tax rate (1 - your tax rate). If you pay 25% tax, your reciprocal would be (1 - .25) = .75, or 75%. Divide this amount into the yield on the tax-free bond to find out the TEY. For example, if the bond in question yields 3%, use (3.0 / .75) = 4%. I Bonds Rates Calculator The bond valuation calculator follows the steps below. Youll get an average rate of 837. But the inflation rate could increase if inflation picks. Also enter the settlement date maturity date and coupon rate to calculate an accurate yield. You can access the rate information from the official Treasury Direct website.

Coupon rate bond calculator. How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ... Bond Yield: Definition & Calculation with Interest Rates Coupon rate: the bond's interest rate which is a percentage of the bond's face value; for example, if a bond has a coupon rate of 5% and a face value of $1,000, ... How To Calculate a Bond Price. I Bonds Rate Calculator Historical and future information also are available. Also enter the settlement date maturity date and coupon rate to calculate an accurate yield. This is currently set at 0 2. Calculate either a bonds price or its yield-to-maturity plus over a dozen other attributes with this full-featured bond calculator. In this case 10714. Bond Pricing | Valuation | Formula | How to calculate with example | eFM Calculate the price of a bond whose face value is $1000, the coupon rate is 10% and will mature after 5 years. The required rate of return is 8%. Coupon payment every year is $1000*10% = $100 every year for a period of 5 years. Hence, Therefore, the value of the bond (V) = $1079.8. The following is the summary of bond pricing:

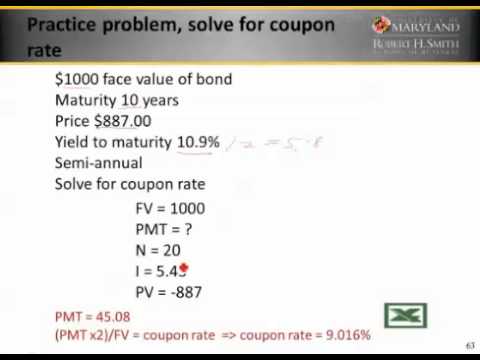

How to Find Coupon Rate of a Bond on Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator This calculator calculates the coupon rate using face value, coupon payment values. How to Perform Bond Valuation with Python | by Bee Guan Teo | Towards ... The YTM of the bond is about 7.89%. Since the bond coupon rate (5%) is less than its YTM, the bond is selling at a discount. On another hand, if the coupon rate is more than its YTM, the bond is selling at a premium. YTM is useful for an investor to determine if a bond is purchased with a good deal.

Coupon Rate: Definition, Formula & Calculation - Study.com C = coupon rate i = annualized interest (or coupon) p = par value of bond Coupon Rate Calculation Example Let's look at an example. XYZ Company, the fictitious maker of widgets, is looking to... How To Calculate YTM (Years To Maturity) On A Financial Calculator Enter the bond's face value. This is the amount of money the bond will be worth when it matures. Enter the bond's coupon rate. This is the interest rate that the bond pays. Enter the number of years until the bond matures. Press the 'Calculate' button. The calculator will now give you the YTM, or years to maturity, for the bond. Keep in ... Coupon Rate - Meaning, Calculation and Importance To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. What Is the Coupon Rate of a Bond? The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

Zero Coupon Bond: Definition, Formula & Example - Study.com Formula & Example. The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i )^ n where: M = maturity ...

[Solved] ou calculate the price from the yields ofzero-coupon bonds? Why could two coupon bonds ...

Quant Bonds - Between Coupon Dates - BetterSolutions.com Price Between Coupon Dates You can calculate the price of a bond for dates between coupon dates by 1) Using the PRICE function. 2) Using the YIELD function - uses clean price as an argument SS What is the Clean Price ? Also known as the Flat Price, Quoted Price This is the price excluding any accrued income Traders usually quote clean prices

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon is calculated by multiplying the coupon rate by the par value (also known as face value) of the bond. The par value of a bond is the amount that the issuer agrees to repay to the bondholder at the time of maturity of the bond. In formula it can be written as follows: Coupon = Coupon Rate X Par Value

Price of a Zero coupon bond - Calculator - Finance pointers The Price of a zero coupon bond is calculated using the following formula : = FV / ( 1 + r ) n. Where. P = Price of a zero coupon bond ; FV = Face value / Maturity value of the zero coupon bond ; r = Discount rate ; n = Term to maturity ; In the calculator below insert the values of Face value / Maturity value of the zero coupon bond, Discount ...

Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures.

How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

Treasury Return Calculator, With Coupon Reinvestment Treasury Return Calculator, With Coupon Reinvestment The Treasury Return Calculator below uses long run 10-year Treasury Data from Robert Shiller to compute returns based on reinvesting the coupon payments. You can see the total returns for the 10 Year Treasury for any arbitrary period from 1871 until today.

Quant Bonds - Between Coupon Dates - BetterSolutions.com There are several ways you can calculate the yield to maturity for dates that fall between coupon dates: 1) Using the IRR function. 2) Using the YIELD function. 3) Using the XIRR function. 4) Using the Secant Method. 5) Using the Bisection Method.

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

I Bonds Rates Calculator The bond valuation calculator follows the steps below. Youll get an average rate of 837. But the inflation rate could increase if inflation picks. Also enter the settlement date maturity date and coupon rate to calculate an accurate yield. You can access the rate information from the official Treasury Direct website.

Calculating Tax Equivalent Yield on Municipal Bonds Here's how you calculate the TEY in a few steps: Find the reciprocal of your tax rate (1 - your tax rate). If you pay 25% tax, your reciprocal would be (1 - .25) = .75, or 75%. Divide this amount into the yield on the tax-free bond to find out the TEY. For example, if the bond in question yields 3%, use (3.0 / .75) = 4%.

Zero Coupon Bond Calculator - Calculator Academy Zero Coupon Bond Formula. The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t. where ZCBV is the zero-coupon bond value. F is the face value of the bond. r is the yield/rate. t is the time to maturity.

Post a Comment for "38 coupon rate bond calculator"